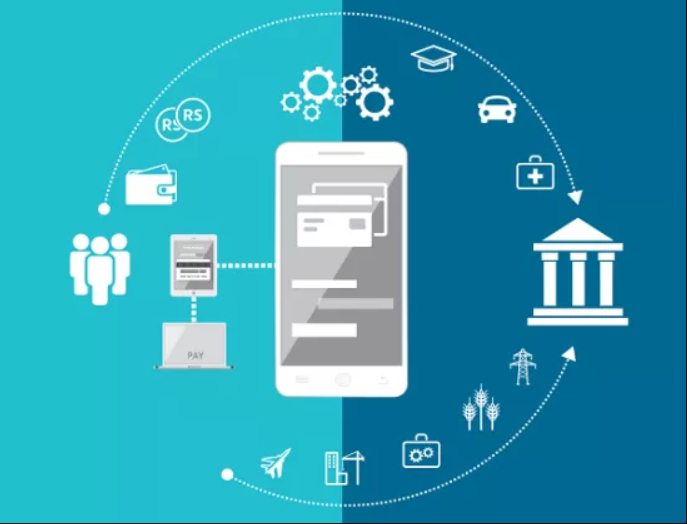

Mobile payment technology has opened up banking services to millions of individuals globally. This revolutionary idea has had a significant influence on financial inclusion, the process of providing individuals and companies with meaningful and affordable financial goods and services that fit their requirements.

Mobile payment technology has increased financial inclusion by offering a quick and affordable alternative to traditional banking. Due to issues including restricted access to physical bank branches, hefty fees, and difficult documentation requirements, many developing nations have a sizable unbanked or underbanked population.

M-Pesa has transformed financial management in sub-Saharan Africa. M-Pesa, launched in Kenya in 2007, allows SMS-based money transfers, bill payments, and loans and savings. The service presently has over 40 million users across Africa, India, and Eastern Europe. M-Pesa and other platforms have promoted financial inclusion in various areas by offering safe, inexpensive financial transactions.

Mobile phones’ ubiquity has facilitated financial inclusion in rural and underprivileged communities.

Remittances are another way mobile payment technology helps financial inclusion. Millions of developing country residents depend on remittances for their income. Traditional remittance channels like banks and money transfer companies can be costly and time-consuming, preventing financial inclusion.

Mobile payment services allow customers to send and receive remittances via their phones, saving time and money. Remittance transactions become faster, cheaper, and easier to administer. This has made international money transfers easier, boosting financial inclusion.

Finally, mobile payment technology has promoted financial inclusion by encouraging financial services innovation. Mobile payment systems have spawned a variety of innovative financial products and services, many of which target underprivileged groups. Mobile-based insurance products, credit scoring systems, and digital savings accounts can increase financial inclusion by offering consumers a wider selection of financial alternatives.

In conclusion, mobile payment technology has transformed global financial inclusion by removing obstacles and allowing millions to engage in the global economy. Mobile payment systems have empowered underprivileged communities by offering a more convenient, inexpensive, and creative alternative to traditional banking services.